Understanding the financial operations of Wellington City Council (WCC) compared to other major New Zealand councils can reveal a lot about how effectively it manages resources and responds to ratepayer needs. By examining areas like revenue, expenditure, debt, and debt servicing per ratepayer, we gain insights into WCC’s fiscal strengths and challenges.

Revenue: How Much Is Wellington Bringing In?

Revenue is the backbone of council operations, funding essential services, infrastructure projects, and public facilities. Wellington’s revenue is primarily sourced from rates, supplemented by fees, grants, and investments. As of the latest data, WCC’s annual revenue per ratepayer is around $4,200, which is slightly higher than the national average for large councils.

Picture source: Wikipedia

Comparatively, Auckland City Council, New Zealand’s largest council, has revenue per ratepayer estimated at $3,800, while Christchurch City Council’s revenue per ratepayer stands near $3,900. Wellington’s higher revenue-per-ratepayer reflects the city’s concentration of businesses and government institutions but also indicates a higher reliance on rate income from residents.

Expenditure: Is Wellington Spending Wisely?

Expenditure per ratepayer is a critical indicator of how councils allocate resources. Wellington’s expenditure per ratepayer is about $4,100 annually, primarily funding urban services, public transport, and social programs. While this is higher than Christchurch’s $3,800 but comparable to Auckland’s $4,000, it highlights WCC’s significant investment in public amenities.

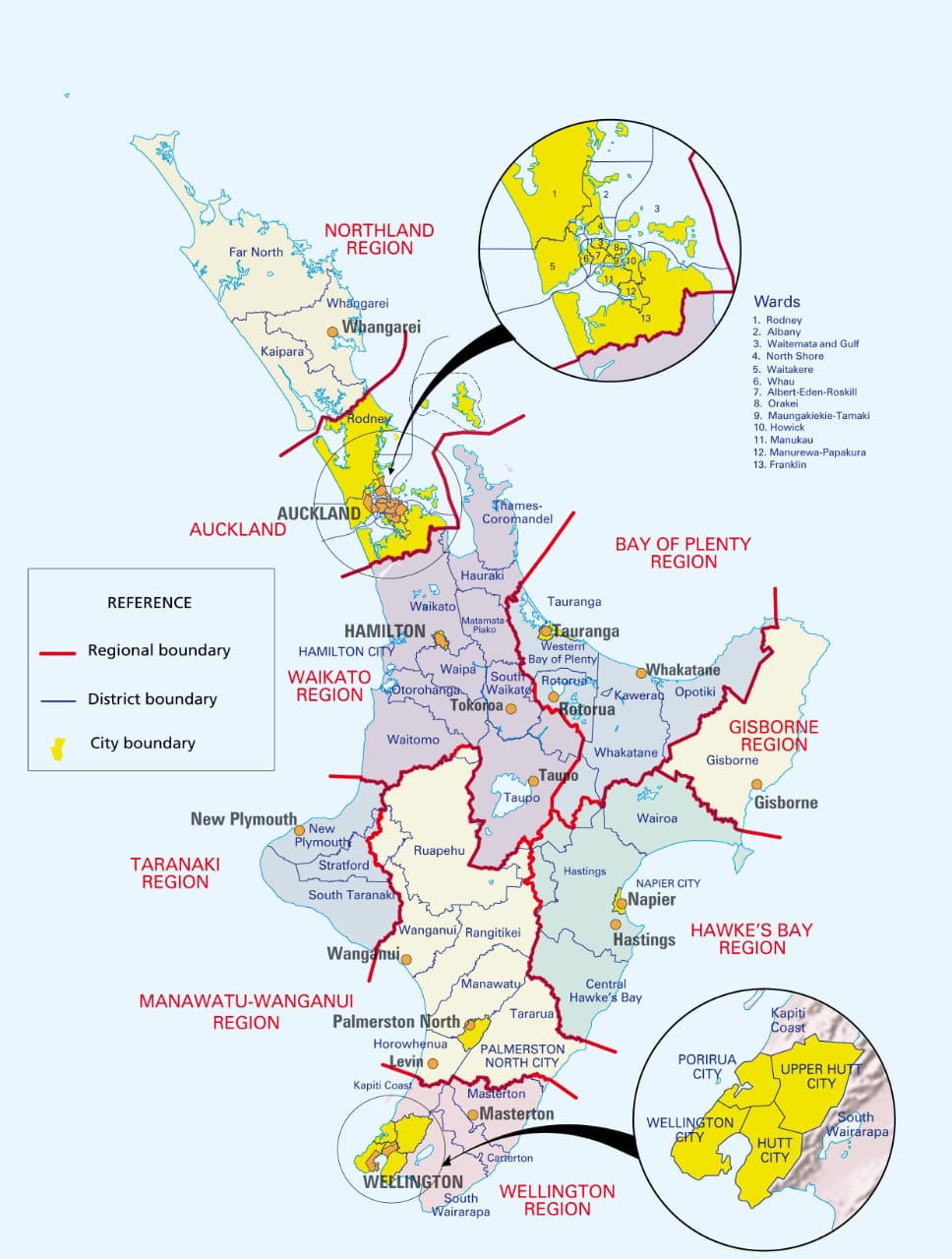

Picture source: workspacearchitects.co.nz

Some ratepayers argue that Wellington’s focus on city-centre improvements, such as the waterfront and green spaces, could be more balanced, with calls for a sharper focus on essential services and infrastructure in suburban areas. This spending balance remains a key issue.

Debt Levels: How Much Is Wellington Borrowing?

Debt per ratepayer is another significant metric. Wellington’s debt is around $5,000 per ratepayer, lower than Auckland’s $8,500 but higher than Christchurch’s $4,500. Although WCC’s debt levels are moderate relative to Auckland’s, they are rising as the council invests in key projects.

Auckland’s substantial debt results from its scale and ongoing infrastructure needs, while Wellington’s debt is linked to projects like the Town Hall restoration and improving earthquake resilience. Nonetheless, some argue that Wellington’s debt could limit future flexibility, especially with growing climate and infrastructure demands.

Debt Servicing: Keeping Up with Repayments

Debt servicing, or the annual cost of repaying loans, adds another layer of financial responsibility for councils. WCC’s debt servicing per ratepayer sits at approximately $320 annually, lower than Auckland’s $500 but on par with Christchurch. Maintaining manageable debt servicing is crucial, as high repayment costs could restrict future spending and place pressure on ratepayers.

Striking a Balance: Financial Sustainability and Ratepayer Needs

For Wellington City Council, achieving a balance between growth and fiscal responsibility remains a challenge. Higher revenue and moderate debt indicate a healthy capacity for investment, yet ratepayers express mixed feelings about spending priorities. While Wellington’s economy relies heavily on public sector funding, its financial outlook suggests stability.

Final Thoughts

In summary, WCC compares reasonably well against larger councils like Auckland, maintaining high revenue and manageable debt levels. However, as projects expand and ratepayer demands increase, ensuring fiscal sustainability while meeting community expectations will be critical for Wellington’s future.